Penalties for those who drive vehicles without insurance include license and registration suspension, plus fines. Drivers who are caught without carrying minimum insurance cannot regain their license until they provide evidence of having an insurance policy for the vehicle in their name.

Call today for free consultation (877)-987-9LAW

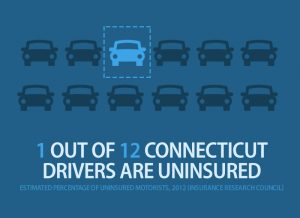

Still, accidents involving uninsured motorists are not uncommon. The Insurance Research Council estimates that 1 out of 8 drivers with whom you share the road do not have even basic insurance coverage.

1 out of 8 drivers on the road is uninsured or underinsured.

The team of attorneys at The Flood Law Firm present this article to those seeking general advice after being in an accident in Connecticut with an uninsured or underinsured driver. Contact us if you need a free consultation or if you have questions regarding your claim.

Car Accidents with Uninsured or Underinsured Driver

The reason that nearly every state requires drivers to have insurance is simple: it is a safety net for those harmed by an accident. At its most basic level, insurance is a pool of funds that helps drivers to pay for the damages and injuries that arise out of a car crash.

But when the driver responsible for the collision turns out to be uninsured, the normal process for victims to achieve compensation may become challenging, especially if injuries and damages are extensive. In many cases, the victim’s own insurance company ends up bearing the financial responsibility to pay for the claim.

It would seem that this situation is exactly what your insurance company is there for. But some insurance companies are unwilling to pay claims involving uninsured or underinsured drivers. When the at-fault driver in your accident does not have sufficient insurance to cover your injury or damage claim, you may find your own insurance provider becomes slow to respond to your claim or even denies it altogether, leaving you to pay for the expenses of the accident out of your own pocket.

An experienced legal expert can protect your claims in the event your insurance company may seek to invalidate your claim. In cases where serious injury has occurred, victims benefit from a no-cost consultation on how to ensure that their claims are fully recognized by their own insurance company.

After a Car Accident with an Uninsured Driver

After a Car Accident with an Uninsured Driver

Since Connecticut law requires drivers to have insurance, some accident victims assume that getting compensated for their injuries is a simple fix: file a lawsuit against the uninsured driver. However, this may not always be a viable option to get the compensation you deserve.

The reason is this: most uninsured drivers have little or no money or assets. (This often plays a part in why they were uninsured in the first place.)

Taking an uninsured driver to court may result in a judgment in your favor, but the end result is unlikely to be money in your pocket. Your claim could be uncollectible since a court cannot force a person who has no money to pay the judgment you may have won. In the best-case scenario, the court will set up a payment plan for the defendant, but this may not offset significant expenses involved in recovering from a serious car accident.

Uninsured and Underinsured Motorist Coverage

Most states require insurance companies to offer uninsured motorist coverage as an add-on to a basic insurance package. The state of Connecticut, in fact, requires drivers to purchase this type of coverage.

The minimum coverage that Connecticut auto policies offer must include the following in respect to uninsured motorist coverage:

$20,000/$40,000 (uninsured motorist coverage per person/accident)

While carrying this required minimum coverage can be very helpful in an accident involving an underinsured driver, it isn’t always enough to cover the repair of your vehicle and medical treatment expenses. It may surprise you that, depending on your policy, your insurance company may take a “credit” for the at-fault driver’s coverage amount and apply it against your policy coverage. This means your insurance will only pay for the difference remaining, and you may not get paid for the full amount of your policy.

In other words, your own underinsured motorist coverage limits can be capped for how much you can collect.

If your medical bills and other accident-related expenses add up to a total higher than your own policy limits, you will end up paying the difference out of pocket. This is how accidents with uninsured motorists in Connecticut can become especially stressful for the victims. Even with the additional coverage you carry that is required by law, being the victim of a car accident with an uninsured motorist can leave you in debt with thousands of dollars in medical bills.

Filing a Claim with your own Insurance Company

Filing a car accident claim that involves an uninsured/underinsured driver should follow the same procedures as any other claim.

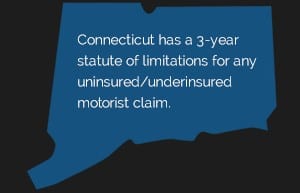

But note that many insurance companies allow you as few as 30 days from the date of the accident to make an underinsured or uninsured motorist claim. Make sure you get informed about your policy, your rights, and take action on filing a claim as soon as possible.

If you are in a situation where an uninsured car accident has left you in a stalemate with your own insurance company, the best thing to do is hire an attorney to help you file an uninsured car accident claim against your insurance provider. In this scenario, you and the insurer enter into a binding arbitration (slightly less formal than an actual lawsuit). The desired outcome of an arbitration is for you and your insurer to settle on a sum that adequately covers your medical and damage expenses from the uninsured car accident.

Even though arbitration may sound less intimidating than going to court, having a successful outcome requires expertise and skill. An experienced car accident attorney can guide you through the arbitration process to make sure that you receive the highest possible payout from your insurance provider.

Hiring the right accident attorney after an uninsured car accident is the best way to make sure that you are fully compensated for the medical bills you have incurred, the wages you have lost during your recovery period, and the pain and loss of well-being you have suffered.

Contact The Flood Law Firm

Uninsured car collisions bring an added twist to the stress and suffering caused by a traffic crash. Lack of proper automobile insurance from all parties involved can create complications in the payment of your claim.

Don’t let someone else’s irresponsibility ruin your life. Don’t leave your case in the hands of an insurance company who only cares about their bottom line. The Flood Law Firm has years of experience helping victims of car accidents and no insurance, in filing claims for financial damages. Our expert attorneys have a proven track record of making sure that car crash victims receive the maximum compensation allowed by law.

Contact us today for a free, no-obligation consultation about your legal options.